Trump’s tariffs strike with devastating consequences

Articles

Sidebar

View more from News & Articles or Primerus Weekly

By Tom Kirvan

The word “tariff” is now casting a vast cloud over the global economy, much the way that the phrase “COVID-19 pandemic” loomed menacingly over society in 2020, the final year of Donald Trump’s first term as president of the United States.

The difference between the two economic shock waves, of course, is that the global pandemic came as a deadly surprise, while the tariffs announced by President Trump on April 2 were part of his carefully planned “Liberation Day” meant to upend the global trade order. In some ways the tariffs have done just that, sending stock markets around the globe spiraling downward, alienating friends and foes alike, and setting the stage for a possible worldwide trade war.

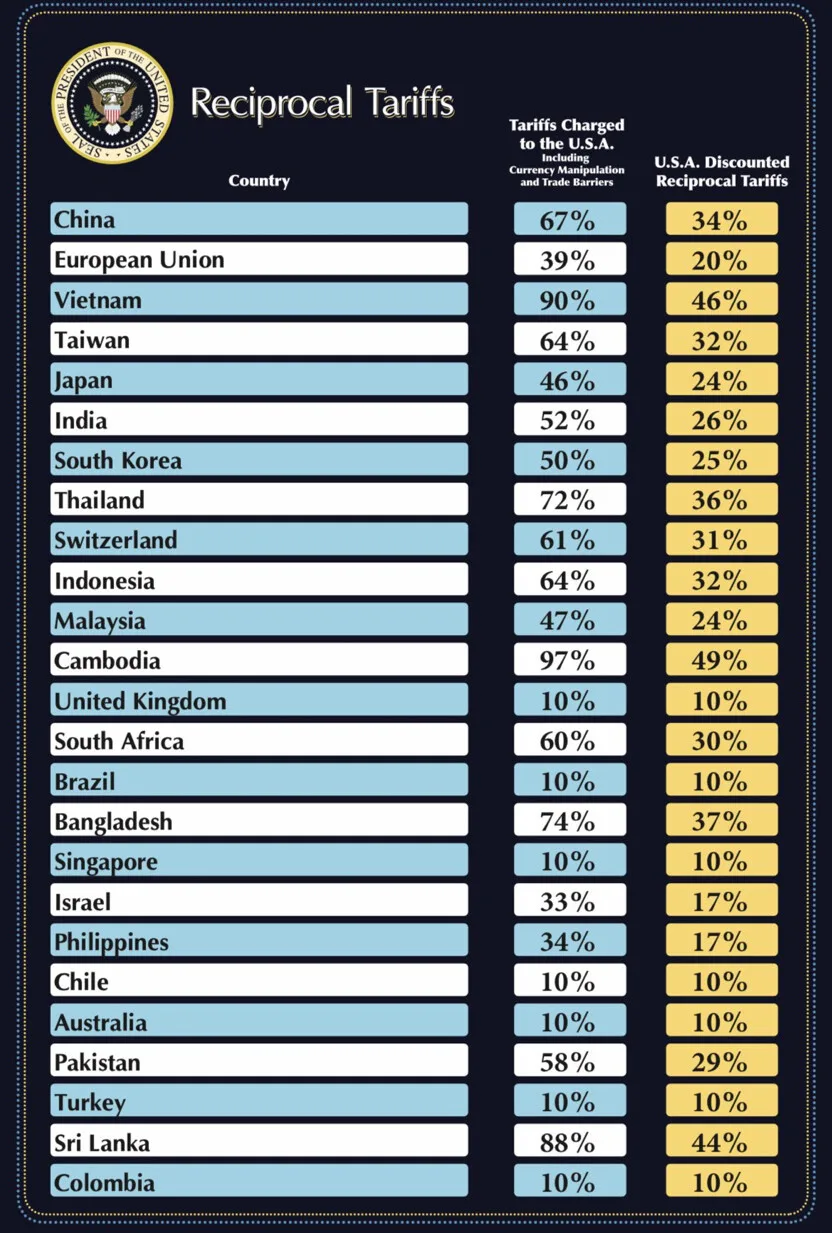

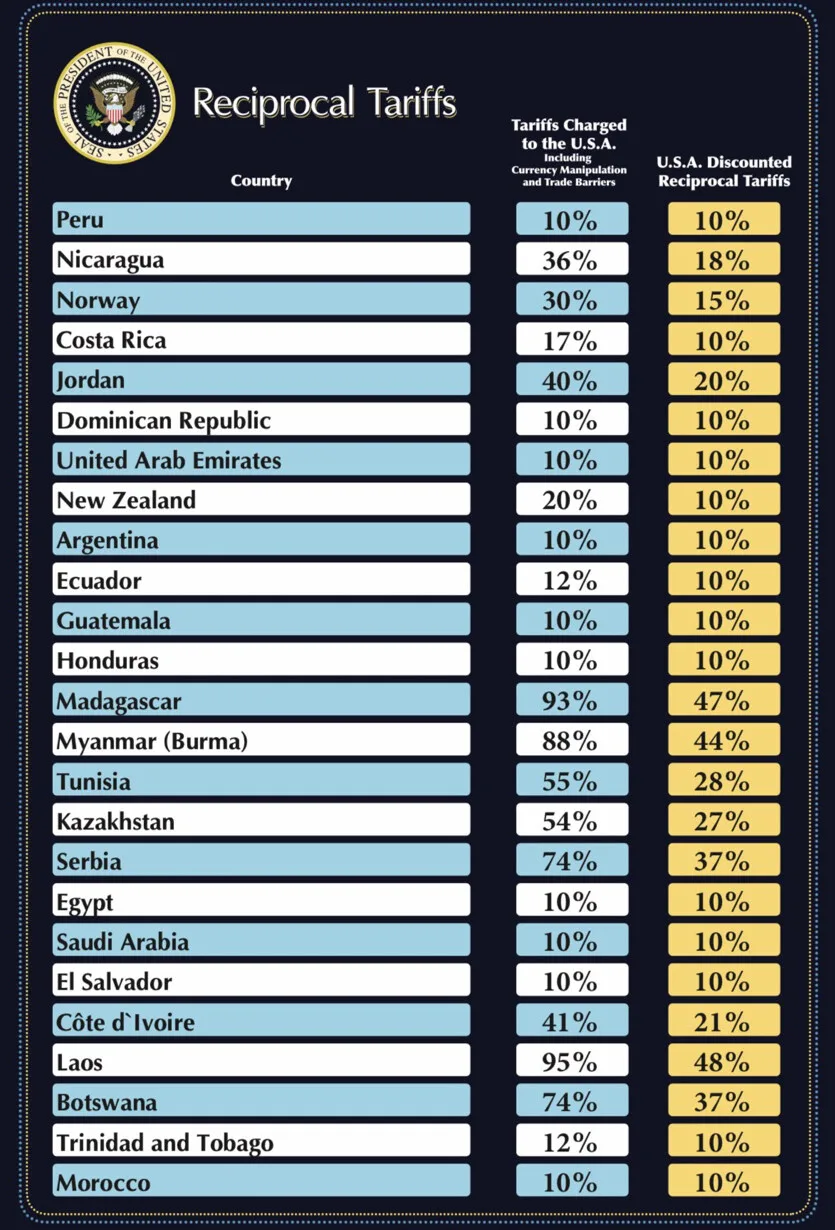

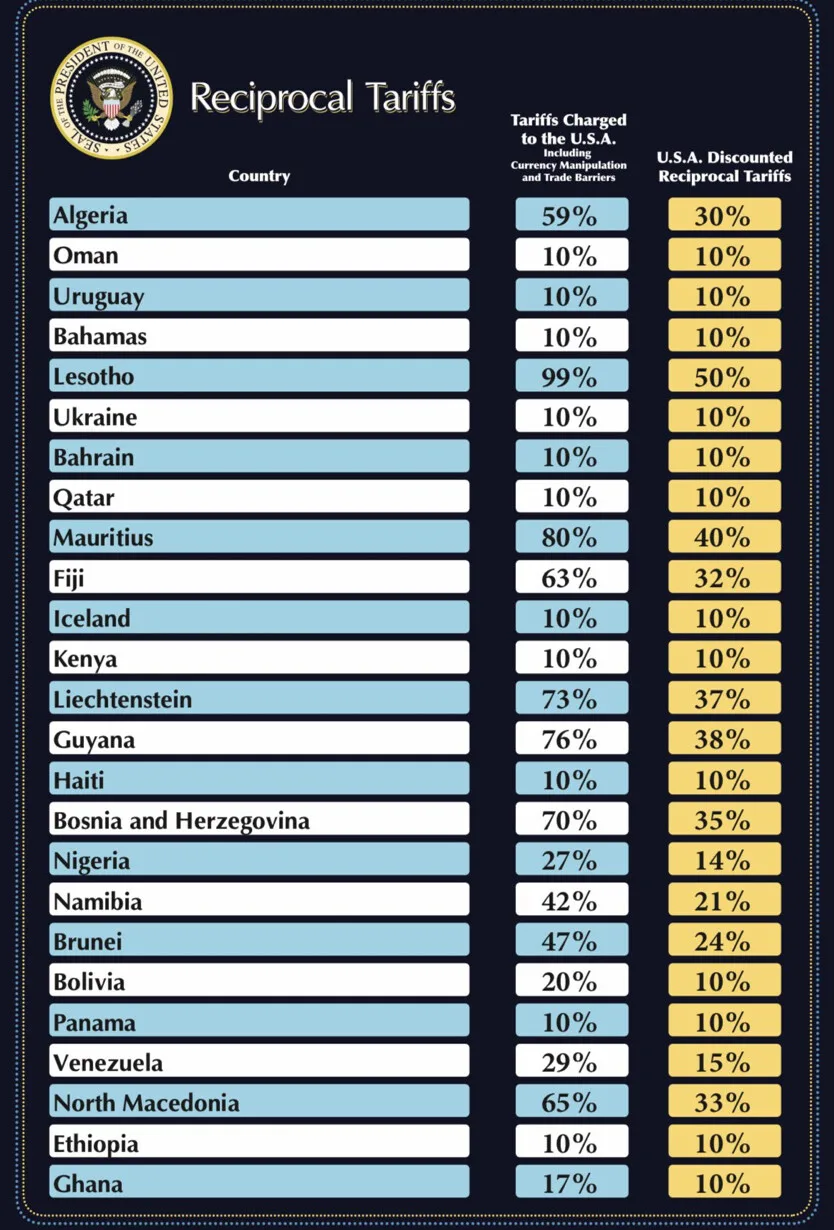

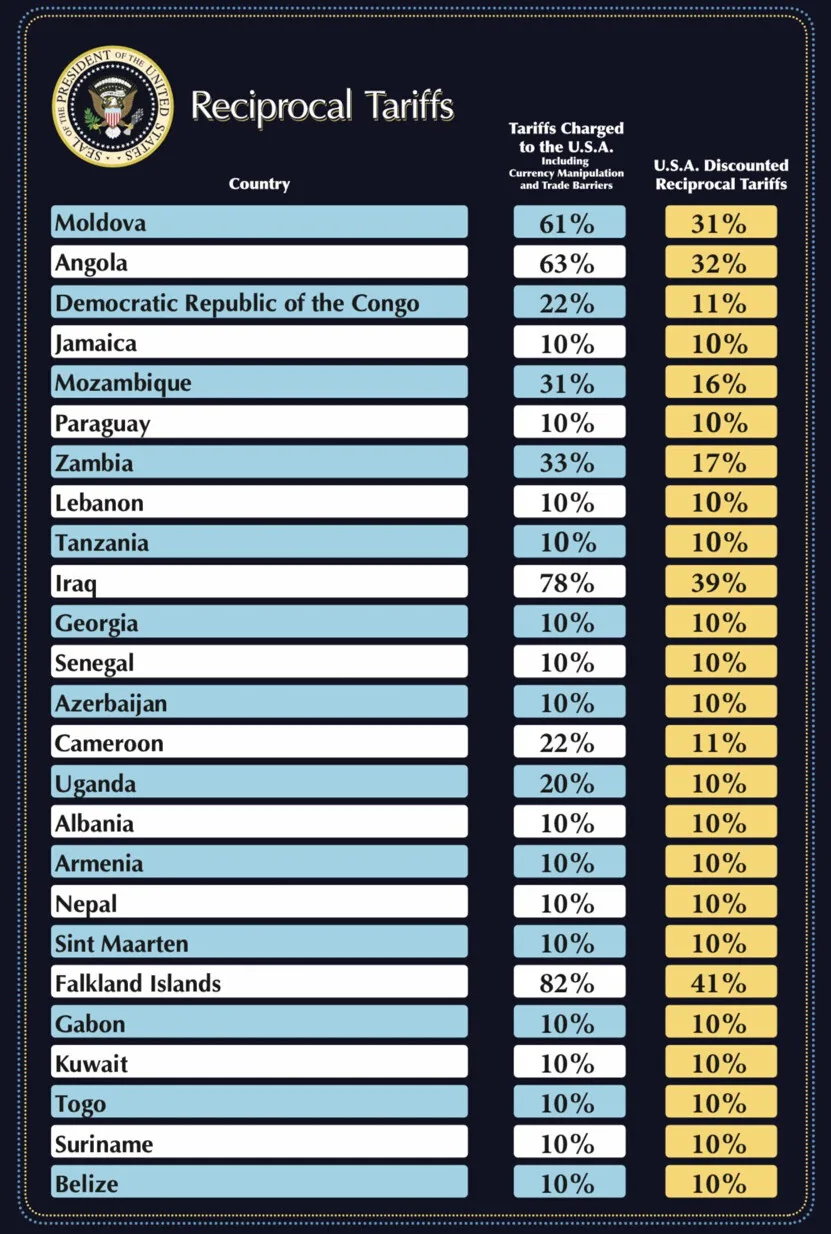

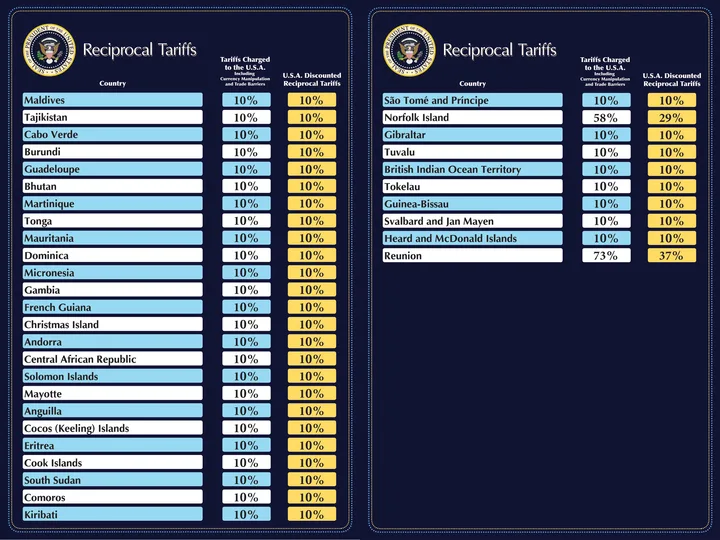

In announcing the sweeping tariffs, ranging from 10 to 61 percent on products imported into the U.S., President Trump claimed his action will generate hundreds of billions in new revenue for the federal government and restore a sense of fairness to global trade.

“Taxpayers have been ripped off for more than 50 years,” Trump said in announcing his tariff policy. “But it is not going to happen anymore.”

Imposition of the tariffs by Trump fulfills a campaign promise and was carried out by executive order without congressional approval under provisions of the 1977 International Emergency Powers Act. He said that the tariffs will “supercharge our industrial base” and will serve as “our declaration of economic independence.” He claimed that the tariffs – which average 23 percent – will bring thousands of manufacturing jobs back into the U.S and will help America sell more of its products overseas.

A number of the nation’s leading economists have cast doubt on Trump’s claims, saying that the tariffs pose the “largest tax increase” since the Revenue Act of 1968, which helped fund the cost of the Vietnam War.

Michael Feroli, the chief economist for JPMorgan Chase, the biggest bank in the U.S., said in a Forbes magazine article that the tariffs will “take the economy perilously close to slipping into recession” and could double the current inflation rate of 2.8 percent.

Feroli’s concerns, according to the article, were also echoed by UBS economist Jonathan Pringle, who predicted that the tariffs will further shake confidence in both the economy and the stock market.

“The expansion was already slowing, fiscal support waning, and consumption strength narrowing,” Pringle stated in the Forbes article.

The stock market took a major hit on April 3, the day after the new round of tariffs were announced, with the Dow plummeting 1,679 points or 3.98 percent. The broader S&P 500 was down by 4.84 percent, while the tech-heavy Nasdaq dropped 5.907 percent. The three major indexes posted their biggest single-day drop since the 2020 pandemic.

“This is a roller coaster market with a wall of worry that’s under construction,” says Terry Sandven, chief equity strategist for U.S. Bank Asset Management Group. “We expect market volatility to remain elevated until we have more clarity.”

The tariff news even prompted the Retail Industry Leaders Association (RILA) – a trade organization traditionally aligned with Republican administrations – to issue a press release proclaiming that Trump’s actions will put a dent in American family budgets.

“The American people are counting on President Trump to grow the U.S. economy and end inflation,” said RILA Senior Executive Vice President Michael Hanson. “Unfortunately, the President’s plan for universal tariffs on household goods – including clothing, groceries, home goods, and school supplies – will raise costs on every American family. The President’s plan is not a targeted attempt to protect American innovation or national security but will hit every family’s budget. Americans cannot afford another round of price increases.

“These newly announced tariffs – and the expected retaliatory tariffs on American businesses – risk destabilizing the U.S. economy, undermining the goals of bolstering domestic manufacturing and growth,” Hanson added. “We urge the President and his economic team not to abandon the pro-growth policies that powered his first term – namely the Tax Cut and Jobs Act. Before lasting damage is done to the economy and family budgets, we urge the White House to reconsider its course.”

Politically, the higher levies on goods from Mexico, Canada, South Korea, Japan, Australia, and other Western and European countries run the risk of turning allies into adversaries, according to several world leaders.

Australia Prime Minister Anthony Albanese, for instance, told reporters that Trump’s tariffs “have no basis in logic and they go against the basis” of the diplomatic alliance between Australia and the U.S.

“This is not the act of a friend,” Albanese said.

European Commission President Ursula von der Leyen was similarly dismayed by the U.S. imposed tariffs, labeling them a “major blow to the world economy.”

Said von der Leyen: “Let’s be clear-eyed about the immense consequences. The global economy will massively suffer. Uncertainty will spiral and trigger the rise of further protectionism.

The consequences will be dire for millions of people around the globe.

“All businesses – big and small – will suffer from day one,” von der Leyen insisted. “From greater uncertainty to the disruption of supply chains to burdensome bureaucracy.”

Which begs the question as to how members of the legal profession should advise their clients in the wake of the new tariff policies, which are expected to disrupt supply chains and take a heavy toll on the automobile, construction, energy, and consumer electronics sectors.

“Proceed with caution” seems to be the underlying message, advice that was underscored by U.S. Sen. Gary Peters of Michigan during a talk presented by the Detroit Economic Club.

“If you’re trying to help an industry, to grow an industry . . . having some certainty is really important,” said Peters, also an attorney and member of the United States Navy Reserve. “Chaos is not good for business.”

And that is why the new rounds of tariffs are proving vexing for companies whose work relies on stable pricing of supplies, many of which are from foreign sources.

“What we’ve seen with this Administration is things can change on a dime, pretty quickly, and that is also part of the problem,” said Peters, emphasizing the importance of seeking legal guidance as businesses pass the cost of the new tariffs down the supply chain.

As an international alliance of independent law firms, Primerus has attorneys all over the world who can offer clients the kind of advice they need to deal with the economic tsunami that recently began hitting in the form of tariffs.

“Our advice today is for clients to call your Primerus lawyer,” said Jack Buchanan, founder and president of Primerus. “We have the attorneys who possess the legal knowledge and wisdom to help guide clients through this particularly challenging and uncertain economic time.”

Relatedly, Buchanan indicated that Primerus soon plans to offer a series of CLE webinars titled “Best Advice to Clients” that will help keep everyone abreast of “ongoing developments in what is shaping up to be a global trade war of immense proportions and catastrophic potential.”

More details on the webinars will be published in upcoming issues of the Primerus Weekly.

Sources: U.S. President Donald Trump via Truth Social and The White House